[ad_1]

Bitcoin (BTC) rose to highs of $10,730 earlier than settling decrease on Oct. 5 as markets fluctuated according to United States President Donald Trump contracting COVID-19.

Cointelegraph takes a have a look at the components set to affect BTC value motion this week, because the virus and its penalties dictate the macro temper.

Trump well being sends markets greater

President Trump buoyed markets late Sunday as merchants priced within the risk that he would go away hospital on Monday after therapy for COVID-19.

Futures had been up, reversing losses on Friday, together with main inventory markets together with the S&P 500, to which Bitcoin continues to indicate excessive correlation.

Trump’s coronavirus prognosis had prompted modest panic late final week, with shares diving and BTC/USD reacting in form, dropping from $10,940 to lows of $10,380.

“It’s been a very fascinating journey; I discovered rather a lot about Covid,” Trump mentioned in a video update posted to Twitter late Sunday, apparently addressed to a crowd of supporters located outdoors his hospital previous to a shock meet-and-greet:

“I discovered it by actually going to highschool — that is the true college; this isn’t the ‘let’s learn the e-book’ college, and I get it, I perceive it. It’s a really fascinating factor and I’m going to be letting you realize about it.”

Wall Road had but to open at publishing time, with resumption of buying and selling set to dictate additional market trajectory for the beginning of the week.

BTC/USD vs. S&P 500 one-year chart. Supply: Skew

Cineworld shares drop 56% on coronavirus shutdown

Past Trump, coronavirus continues to create uncertainty within the U.S. and overseas.

New York continued with phased infrastructure shutdowns on Monday, whereas in Europe, the worsening an infection charge prompted Paris to shut sure institutions.

In a contemporary toll to enterprise, in the meantime, Cineworld, the world’s second-biggest movie show chain, mentioned it might shut its whole operation in each the U.S. and United Kingdom till additional discover from Oct. 8. Its shares subsequently plunged 56% to a brand new all-time low.

However, rumors abound that Trump’s state of affairs might in reality spur each political sides in Washington to succeed in a stimulus deal, one thing which might have a right away influence on markets.

As Cointelegraph reported, Treasury Secretary Steven Mnuchin had already alayed fears of a continued stalemate by confirming that no matter occurs, the bundle would come with one other $1,200 stimulus examine for eligible People.

The long-term influence of state-sponsored revenue is in itself controversial, with commentators beforehand arguing that after carried out, the checks could be tough to easily “flip off.”

On the time that the primary spherical of checks hit in April, cryptocurrency exchanges observed elevated quantity particularly for the quantity of the $1,200 payouts.

BTC/USD one-week chart. Supply: Coin360

Brexit deadline looms… once more

Europe’s flip in highlight relating to macro market actions might lie forward of it, as last-minute intense talks over Brexit acquired underway Monday.

Lengthy a contentious difficulty for the British pound and its merchants, the Brexit deal — or lack of it — has beforehand even managed to supply knock-on results for Bitcoin.

This time round, the talks purpose to supply a compromise earlier than an important European Union assembly on Oct. 15, with a practical deadline to supply consensus now set for someday in early November.

Requested what the influence of no deal could be, U.Ok. prime minister Boris Johnson informed a BBC radio present that the nation “may greater than reside with it.”

In London, FTSE 100 futures had been nonetheless up on Monday, greater than reversing their losses from all through the earlier week’s buying and selling.

Together with Brexit, as Cointelegraph famous, the Financial institution of England is at the moment researching the concept of introducing damaging rates of interest for the primary time in its historical past.

Bitcoin problem, hash charge come down from peak

Current promoting stress meant that Bitcoin’s fundamentals had been unable to proceed their report successful streak.

Difficulty, maybe a very powerful measure of miner well being, barely moved at its newest readjustment on Oct. 4. Beforehand, estimates prompt that the metric would construct on present all-time highs to shoot greater nonetheless.

Within the occasion, a 0.09% dip extinguished optimism, which was working excessive after the earlier readjustment noticed an 11.35% uptick.

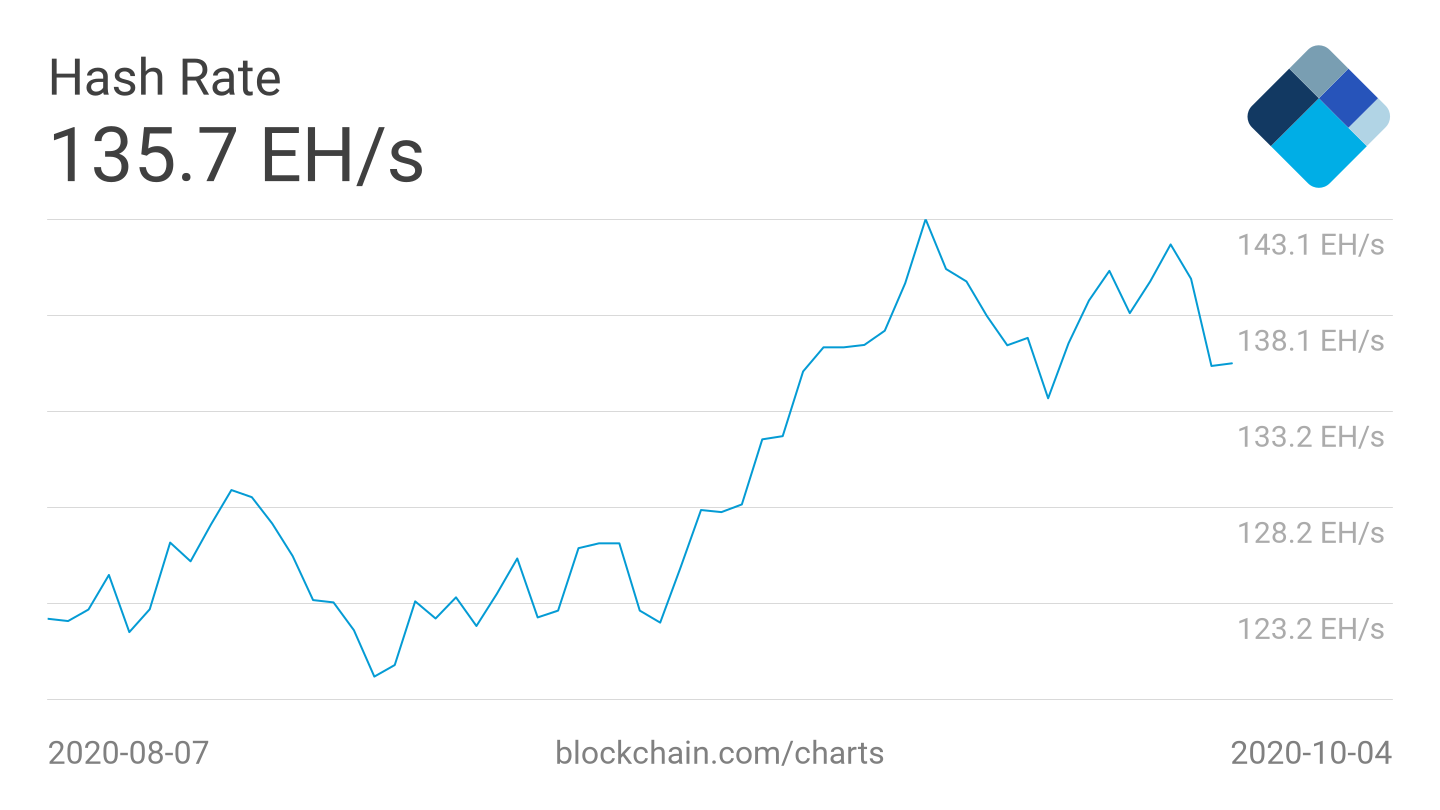

Hash charge, a measure of the computing energy devoted to validating the Bitcoin blockchain, was additionally flat on Monday, hovering at 135 exahashes per second (EH/s).

Seven-day hash charge highs had reached a report 143 EH/s in September, with one other surge to 141 EH/s on Oct. 1.

Bitcoin seven-day common hash charge two-month chart. Supply: Blockchain

As Cointelegraph reported, one other problem metric, Issue Ribbon Compression, confirmed a way more bullish development final week.

PlanB on stock-to-flow: Time for divergence

Zooming out, Bitcoin analysts appeared as happy as ever with the most important cryptocurrency’s efficiency.

For quant analyst PlanB, creator of the stock-to-flow household of BTC value fashions, it was now time for Bitcoin to observe its historic development and put in contemporary beneficial properties.

The impetus was the 200-week transferring common (200WMA), which on Oct. 4 reached a brand new all-time excessive of $6,800.

A well-liked value function for PlanB, the 200WMA has by no means been damaged in value downtrends, and at the moment will increase by round $200 every month. Analyzing the newest information from stock-to-flow, PlanB summarized on Twitter:

“Time for the purple and orange dots to divert from 200WMA once more.”

Such conduct, the place the dots characterize BTC/USD in accordance with its distance from halving occasions, has repeated following each the 2012 and 2016 halvings.

Bitcoin stock-to-flow chart as of Oct. 5. Supply: PlanB/Twitter

[ad_2]

Source link