[ad_1]

At first of October, the crypto market was confronted with extraordinarily tumultuous monetary circumstances, thanks largely to the current filings towards BitMEX, which noticed the corporate’s prime brass being indicted by the USA Commodity Futures Buying and selling Fee on a number of prices. Not solely that, however just some days earlier than the BitMEX scandal got here to gentle, cryptocurrency trade KuCoin was hacked to the tune of over $275 million on Sept. 26.

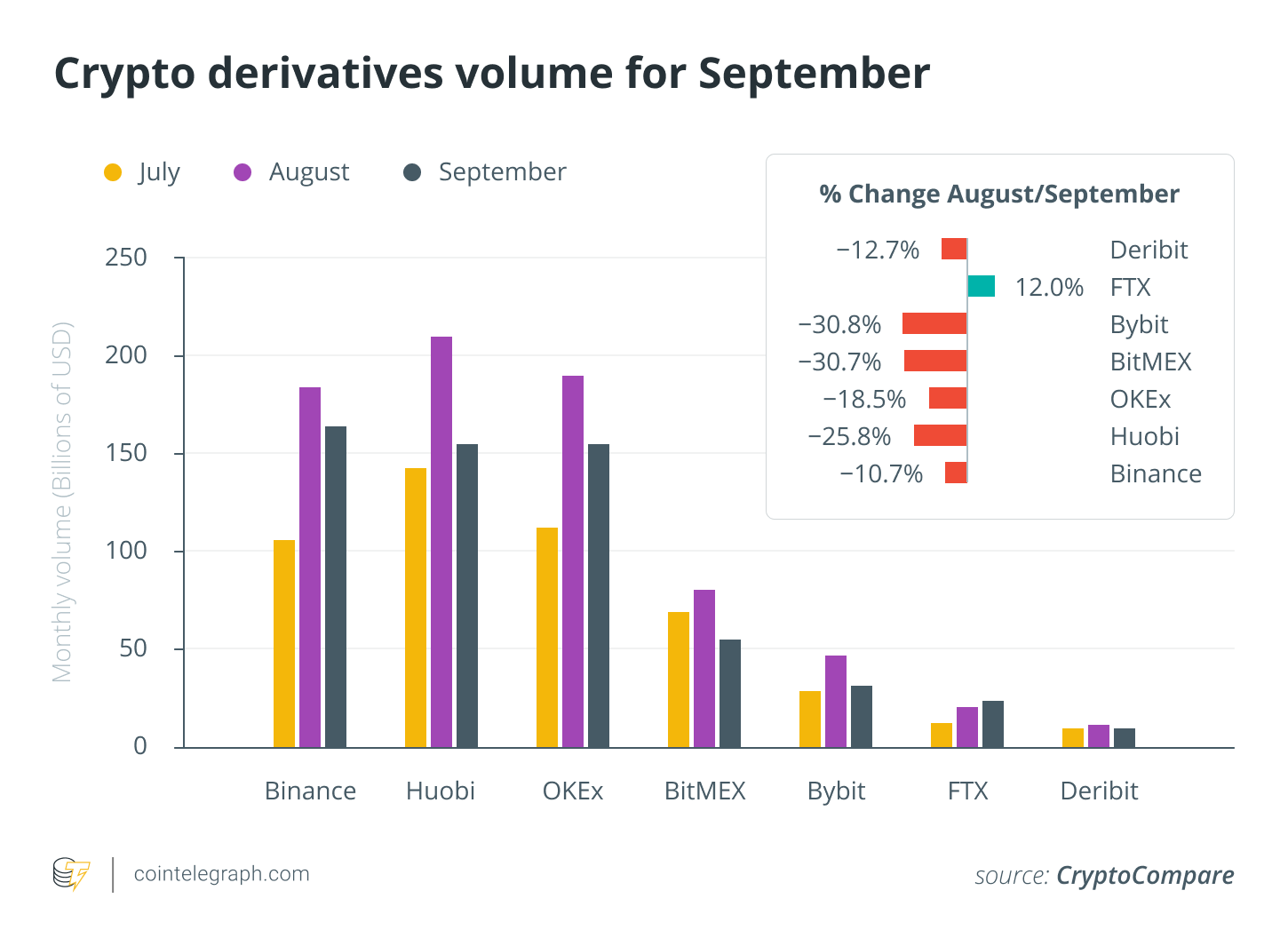

Within the midst of all this, the crypto derivatives market additionally witnessed a serious improvement within the type of Binance overtaking Huobi and OKEx to turn out to be the biggest crypto derivatives trade by quantity for the month of September, with the platform recording a complete commerce quantity of $164.8 billion for the month.

The information, launched by U.Okay.-based crypto analytics agency CryptoCompare, took into consideration the buying and selling quantity of the aforementioned exchanges and located that Binance drew in a complete of $8 billion extra in commerce quantity than its closest competitor, Huobi, which raked in $156.3 billion throughout the identical time interval, whereas OKEx drew in round $155.7 billion.

Binance and OKEx demonstrated comparatively related derivatives volumes throughout July and August; nonetheless, it’s value noting that in this similar time window, Huobi had fairly a margin on each its closest rivals. This then poses the query of how Binance was in a position to make such strides in only one month to overhaul Huobi and OKEx so rapidly. Offering his ideas on the topic, Jay Hao, CEO of OKEx, advised Cointelegraph:

“Binance held a $1.6 million buying and selling competitors on its futures trade to mark its one yr anniversary in September. This will likely have led to the sudden fast spike in quantity and in addition clarify why the OI is so low in comparison with OKEx, as merchants didn’t open lengthy positions however had been competing for his or her share of the prize pool.”

What fueled Binance Future’s rise?

In response to a Binance spokesperson, one of many key drivers that helped spur the current market efficiency was person suggestions, particularly in regard to the less-than-ideal buying and selling experiences that many purchasers had beforehand confronted on different derivatives exchanges: “They advised us about system outages or instability, interfaces that weren’t user-friendly, and that every one the exchanges then had been solely providing incentives for market makers, which created a lopsided setting that deprived market takers.”

One other occasion which will have bolstered market confidence in Binance’s derivatives arm was Black Thursday, or March 12, a day that vastly impacted each conventional and crypto markets. Whereas many different derivatives exchanges encountered vital outages, Binance supplied uninterrupted service to its clients, thereby doubtlessly cementing confidence within the platform.

Lastly, through the course of summer time this yr, a lot of customers moved from Bitcoin to varied altcoins and DeFi-based derivatives. Throughout this transitional part, Binance Futures expanded its choices pool. The Binance spokesperson famous: “There’s additionally higher consciousness on how we stability Bitcoin and altcoins; altcoin futures volumes make up round 40% on Binance. We predict we perceive and mirror market circumstances properly.”

OKEx levels a comeback

Whereas September noticed Binance lead the derivatives roost, heading into October, OKEx is main all Bitcoin futures exchanges when it comes to Bitcoin futures open curiosity. In its most simple sense, open curiosity signifies the whole variety of excellent by-product contracts — be it choices or futures — which can be but to be settled. From a extra technical standpoint, open curiosity serves as an indicator of choices buying and selling exercise and whether or not or not the whole sum of money coming into the derivatives market is growing.

On Oct. 4, OKEx’s 24-hour buying and selling quantity was over the $1.3 billion mark, dwarfing the $1.23 billion commerce quantity of its closest competitor, Binance Futures. Moreover, as might be seen from the chart above, open curiosity on OKEx is the very best by a large margin, with the opposite 5 exchanges performing equally to at least one one other.

Such constructive statistical information appears to recommend that BTC futures and choices sentiment has remained fairly sturdy, regardless of the current BitMEX lawsuit and KuCoin hack. Not solely that, however OKEx’s futures open curiosity has risen from $850 million to $930 million because the begin of October, one thing that’s doubtlessly indicative of a bull run within the close to future. Offering his insights on the topic, Hao advised Cointelegraph:

“Buying and selling quantity is an important metric however it’s not the one metric to bear in mind when assessing the general well being and recognition of an trade. OKEx has been laser-focused on DeFi currently as properly and this transfer from Binance in derivatives is a sign for us that we can not take our consideration from our flagship product.”

U.Okay. ban on native derivatives market may harm

On Oct. 11, the UK’s Monetary Conduct Authority — the nation’s principal finance regulator — issued a blanket ban prohibiting crypto service suppliers from promoting derivatives and exchange-traded notes to retail traders. Whereas the U.Okay. derivatives market is probably not massive compared to others, the truth that a outstanding regulator such because the FCA continues to claim that “cryptoassets are inflicting hurt to customers and markets” is relatively alarming for the trade.

The federal government company continues to be alleging that digital belongings don’t have any inherent worth — an argument that has been used towards crypto since its inception. Furthermore, another excuse for the ban is the “excessive risky nature” of crypto, which looks as if one other unjust analysis contemplating the identical might be mentioned about many conventional inventory choices. The FCA claims that retail traders “don’t perceive sufficient in regards to the derivatives market,” so there isn’t a actual want for them to put money into such choices.

That being mentioned, it’s value remembering that when the ban was proposed in July final yr, it generated a complete of 527 responses from varied firms that promote derivatives in addition to crypto exchanges, regulation companies, commerce our bodies and different entities. In a 55-page report launched by the FCA, a staggering 97% of respondents are proven to have opposed the proposal.

[ad_2]

Source link