[ad_1]

Chicago Mercantile Change’s cash-settled Bitcoin (BTC) futures buying and selling merchandise “contribute extra to cost discovery than its associated spot markets,” in response to findings in a brand new report by funding agency Wilshire Phoenix.

The rising volumes of crypto spinoff merchandise spotlight larger participation from institutional buyers and it will possible be constructive for the whole crypto area.

This isn’t distinctive to cryptocurrencies as a result of even in most different asset courses, the derivatives markets lead the spot markets.

In a separate try to find out the valuation of Bitcoin, a number of specialists from JPMorgan Chase opined that Bitcoin’s value is overvalued in comparison with its intrinsic worth and the analysts steered that BTC might face promoting within the short-term.

The analysts take into account Bitcoin to be a commodity and have calculated its marginal value of manufacturing to estimate its intrinsic worth.

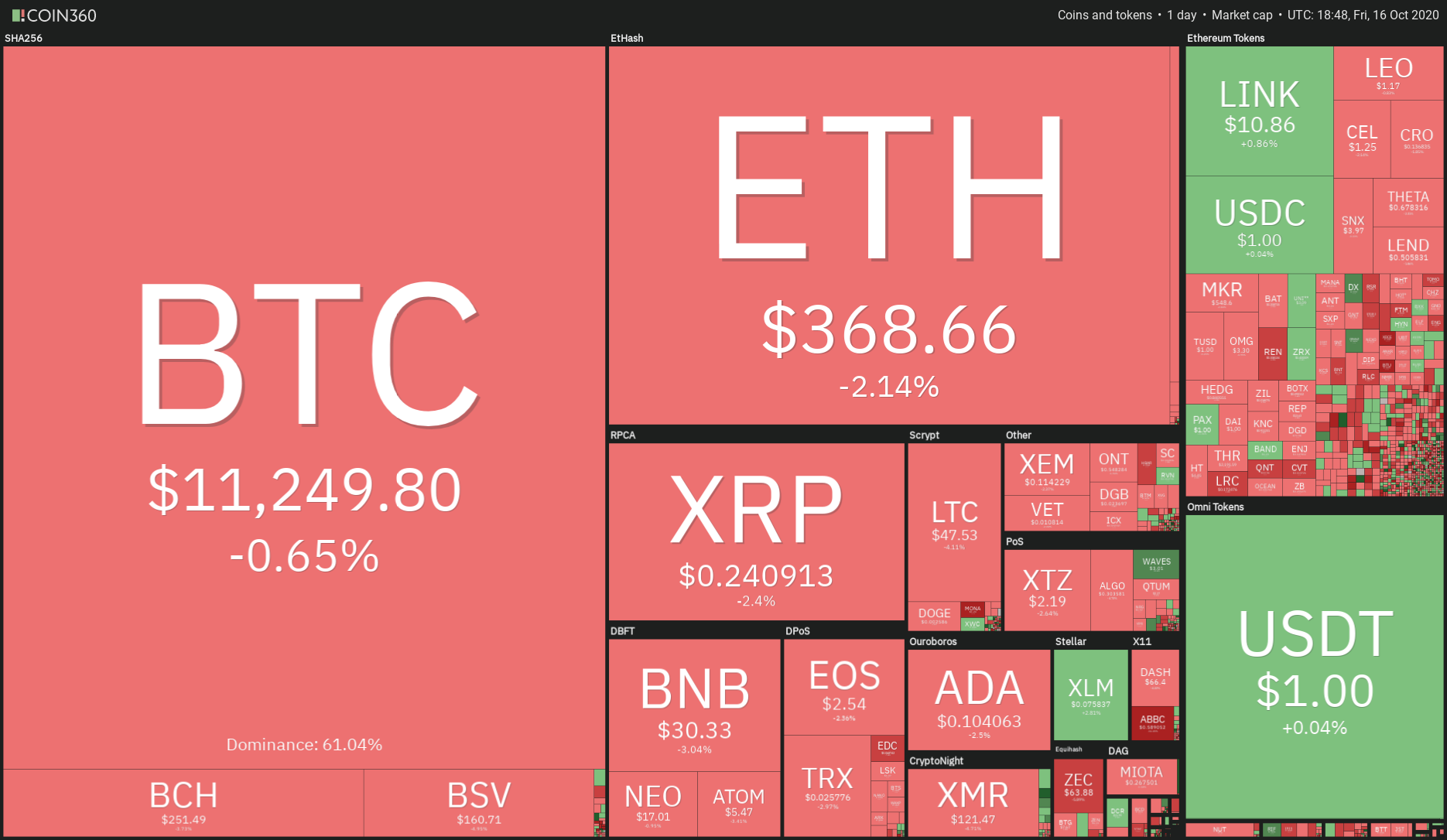

Whereas fundamentals do work within the long-term, short-term value motion is normally dictated by sentiment and technicals. Let’s analyze the charts of the top-10 cryptocurrencies to find out the trail of least resistance.

BTC/USD

Bitcoin (BTC) bounced off the $11,178 assist on Oct. 15 however the bulls couldn’t maintain the value above $11,500. This weak point might have attracted revenue reserving by the short-term merchants and shorting by the aggressive bears.

The bears are presently trying to sink the value again under the vital assist at $11,178. Nevertheless, this stage is prone to appeal to consumers as a result of the 20-day exponential transferring common ($11,081) is positioned just under this assist.

The upsloping 20-day EMA and the relative energy index within the constructive territory recommend that consumers have the higher hand.

If the bulls can push the value above the downtrend line, it is going to be the primary signal of energy. The uptrend might decide up momentum after the bulls can maintain the BTC/USD pair above the ascending channel.

Opposite to this assumption, if the bears sink the pair under the 20-day EMA, a drop to the assist line of the channel is feasible. A breakdown of the channel might spark additional promoting, which might lead to a drop to $10,000.

ETH/USD

The bears are presently trying to maintain Ether (ETH) under the transferring averages. In the event that they succeed, a drop to the uptrend line is feasible. If this assist additionally cracks, it’ll point out a range-bound motion for the largest altcoin for a number of extra days.

The flat transferring averages and the RSI close to 50 additionally level to a steadiness between provide and demand.

Nevertheless, if the ETH/USD pair turns up from the present ranges or the uptrend line, the bulls will once more attempt to push the value above the overhead resistance at $395. If they’ll pull it off, it’ll full an ascending triangle sample that has a goal goal of $481.608.

XRP/USD

XRP broke under the transferring averages on Oct. 15 and is on its option to the vital assist at $0.2295. Though the altcoin had shaped a bullish inverse head and shoulders sample, the bulls couldn’t push the value above the neckline at $0.26 and the setup didn’t full.

The present value motion of the altcoin is an effective instance of why merchants ought to look forward to the setup to finish earlier than taking a directional wager. Shopping for in anticipation might shortly flip the commerce right into a loss.

The XRP/USD pair is presently range-bound between $0.2295 and $0.26, therefore, the bulls are possible to purchase close to the assist of the vary.

A trending transfer will begin after the bulls push the value above $0.26 or the bears sink the pair under $0.219712.

BCH/USD

Bitcoin Money (BCH) witnessed sharp promoting at $266.46 that resulted in a retest of the breakout stage at $242. The sharp rebound off this assist means that the bulls aggressively amassed at decrease ranges and $242 has now flipped from resistance to assist.

The upsloping 20-day EMA ($238) and the RSI above 60 means that the bulls have the higher hand. If the consumers can push the value above $266.46, the uptrend might attain $280 after which $300.

This assumption might be invalidated if the bears promote on the present ranges and sink the BCH/USD pair under the transferring averages. If that occurs, the pair might once more drop to $215.

BNB/USD

Binance Coin (BNB) has circled from $31.9798 in the present day because the bears try and stall the uptrend and sink the value again under the assist at $29.5646 and the 20-day EMA at $28.77.

If the sellers can handle to maintain the value under the 20-day EMA, it’ll recommend that the bullish momentum has weakened. A break under $26 might recommend the beginning of a deeper correction to $22.

Nevertheless, if the BNB/USD pair rises from the $22.5646 assist or the 20-day EMA, the bulls will once more attempt to resume the uptrend.

A powerful rebound will recommend that the bulls are aggressively accumulating on dips, whereas a weak rebound will point out an absence of demand, therefore, the bears might pounce on it.

Due to this fact, merchants can control the energy of the rebound to find out whether or not the up-move will resume or the rally will fizzle out at greater ranges.

LINK/USD

Chainlink (LINK) turned down from the 50-day easy transferring common ($11.22) on Oct. 13 however the constructive factor is that the bulls try to arrest the pullback on the 20-day EMA ($10.40).

A powerful rebound off the 20-day EMA would be the first signal that the sentiment has turned from promote on rallies to purchase on dips. The primary goal is $12 and above this, the LINK/USD pair might attain $13.28.

Nevertheless, if the rebound off the 20-day EMA is weak, it might once more face stiff resistance on the 50-day SMA. If the pair as soon as once more turns down from this overhead resistance, it’ll enhance the potential for a decline to $8.7975.

DOT/USD

Polkadot (DOT) has turned down from the 20-day EMA ($4.22) and the bears will now attempt to sink the value under the $3.5321 assist. If the bears handle a detailed (UTC time) under $3.5321, it’ll full a descending triangle sample.

This bearish setup has a goal goal of $1.4743. Nevertheless, it is probably not a straight fall to this stage as a result of the bulls might step in and supply assist at $2.60 and once more at $2.

Opposite to this assumption, if the DOT/USD pair turns up from the present ranges or rebounds off $3.5321, the bulls will attempt to push the value above the resistance line of the descending triangle.

If that occurs, it’ll invalidate the bearish sample and that might lead to an up-move to $4.6112 after which $5.5899.

ADA/USD

The bulls couldn’t drive Cardano (ADA) above the neckline of the doable inverse head and shoulders sample. This might have attracted revenue reserving by the short-term bulls and promoting by the aggressive bears leading to a drop to the 20-day EMA ($0.10).

Because the 20-day EMA is sloping up marginally and the RSI is within the constructive zone, the bulls might defend this assist. If the ADA/USD pair rebounds off the 20-day EMA, the bulls will attempt to push the value above the neckline.

In the event that they succeed, the pair might begin a brand new uptrend which will attain $0.128062 and above it $0.1445.

This constructive view might be invalidated if the pair continues to slide and it breaks under the 50-day SMA ($0.098). Such a transfer might lead to a drop to $0.090.

LTC/USD

Litecoin (LTC) has dropped under each transferring averages in the present day, which means that the bears used the rally to the $51 resistance to provoke quick positions. Nevertheless, the bulls haven’t but given up as they’re presently trying to defend the uptrend line.

If the bulls fail to push the value above the transferring averages, the promoting is prone to intensify and the bears will as soon as extra attempt to sink the LTC/USD pair under the uptrend line. In the event that they succeed, a drop to $42 is feasible.

Conversely, if the pair rises above the transferring averages, the bulls will attempt to thrust the value above the $51–$52.36 resistance zone. In the event that they succeed, the inverse head and shoulders sample will full and it has a goal goal of $60.3702.

BSV/USD

Bitcoin SV (BSV) has damaged under the transferring averages and is now prone to stay range-bound between $180.63 and $146.20. The autumn in the present day has invalidated the potential for an inverse head and shoulders sample.

The 20-day EMA ($166) is flat however the 50-day SMA ($167) is sloping down and RSI has dropped under 42, which suggests a slight benefit to the bears. A break under $146.20 might begin a brand new downtrend.

Nevertheless, if the BSV/USD pair recovers from the present ranges or from the $146.20 assist, the bulls will make yet one more try and drive the value above $180.63. An in depth (UTC time) above this resistance might begin an up-move to $210.

The views and opinions expressed listed here are solely these of the creator and don’t essentially replicate the views of Cointelegraph. Each funding and buying and selling transfer includes danger. You must conduct your personal analysis when making a call.

Market information is supplied by HitBTC change.

[ad_2]

Source link