[ad_1]

Information from Arcane Analysis exhibits Bakkt Bitcoin trade noticed one other record-high month from Sept. 20 to Oct. 20. This follows a noticeable rise in institutional demand for Bitcoin (BTC) from public firms in latest months.

Bakkt, the digital asset cost platform and derivatives trade, is tailor-made for institutional buyers within the U.S. It’s operated by Intercontinental Alternate, the mother or father firm of the New York Inventory Alternate.

When the amount of the Bakkt Bitcoin futures market will increase, which bodily settles Bitcoin contracts, it usually demonstrates development in institutional urge for food for digital belongings.

CME, LMAX Digital, and Bakkt volumes present the institutional Bitcoin market is rising quickly

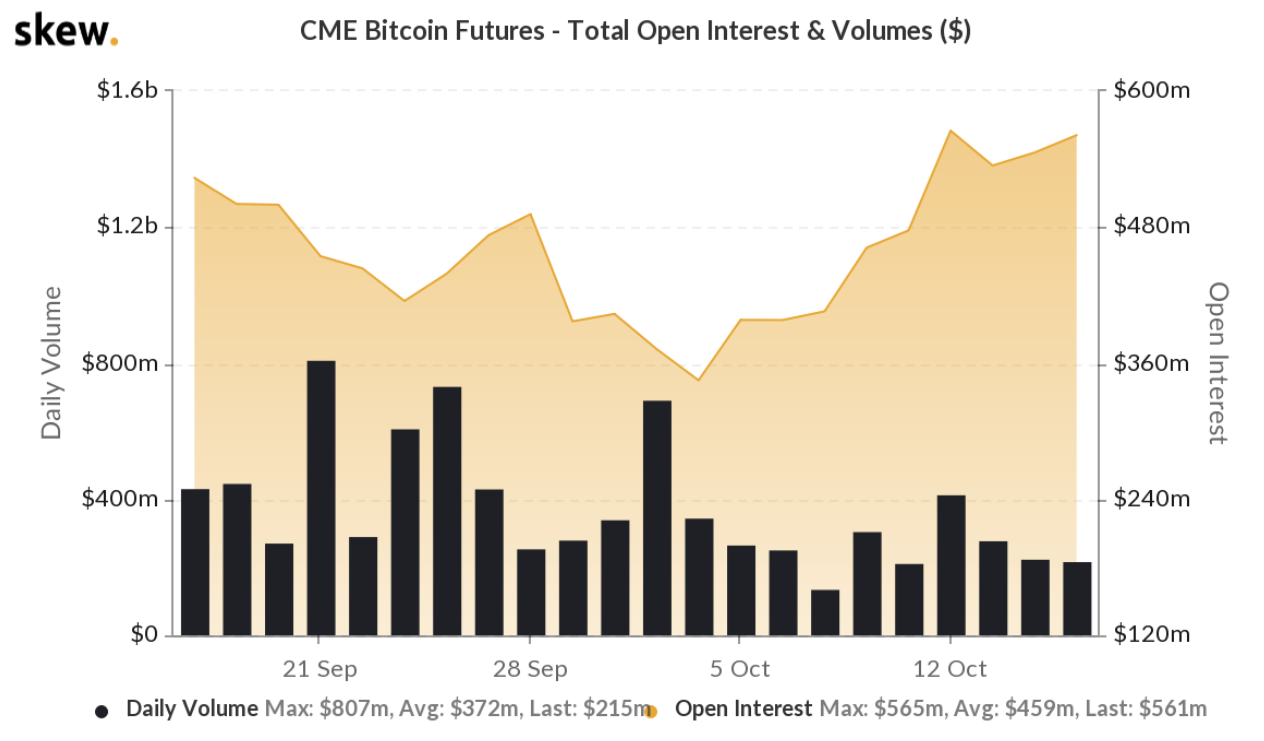

As proven above, Cointelegraph and Digital Assets Data replicate a big surge in futures volumes throughout a number of exchanges within the month of October.

In response to the analysts at Arcane Analysis, 400 BTC contracts are set to run out in October at Bakkt. Month-over-month, the information exhibits a 14% leap from September.

Bakkt’s quantity and open curiosity are vital in gauging institutional exercise as a result of it is without doubt one of the three extensively utilized platforms by establishments alongside LMAX Digital and CME.

As such, Arcane Analysis stated that the substantial enhance in futures contract deliveries on Bakkt signifies rising institutional demand. The researchers noted:

“One other ATH BTC supply on Bakkt this month. Over 400 BTC futures contracts have been held to expiry in October, a rise of 14% from September. With one other record-breaking month on Bakkt, the demand for bitcoin is rising amongst institutional buyers.”

Atop the excessive buying and selling exercise on Bakkt, LMAX Digital and CME are additionally constantly posting massive demand.

Information from Skew exhibits that LMAX Digital stays the most important spot trade within the international market by quantity. In response to Skew, LMAX Digital processed $135.6 million price of BTC within the final 24 hours. This exceeded the every day quantity of Coinbase, Kraken, and different main retail-focused exchanges.

Since LMAX Digital primarily facilitates trades for establishments, the trade surpassing Coinbase depicts the present institutional panorama of Bitcoin. There’s sturdy demand coming from establishments, particularly following latest excessive profile investments of Sq. and MicroStrategy.

Just like Bakkt, the CME Bitcoin futures market has additionally seen a rise in open curiosity. Since Oct. 2, following the month-to-month expiry for September, CME’s Bitcoin open curiosity rose from $345 million to $561 million.

Trade executives view institutional development as a constructive

Trade executives and high-net-worth buyers within the cryptocurrency market anticipate the development of rising institutional urge for food for Bitcoin to proceed.

Tyler Winklevoss, the billionaire Bitcoin investor and the co-founder of Gemini, stated Bitcoin is steadily evolving into a company treasury asset.

When MicroStrategy introduced that it acquired $425 million price of BTC, the corporate emphasised that it considers BTC because the agency’s major treasury asset. Winklevoss wrote:

“Bitcoin is on its option to turning into a company treasury asset. Michael Saylor and Jack are main the cost. Quickly many different firms will observe, and ultimately central banks. That is just the start.”

[ad_2]

Source link