[ad_1]

Decentralized finance’s (DeFi) explosive third-quarter introduced important progress to Ethereum (ETH)-compatible stablecoins.

In response to crypto market knowledge aggregator Messari, the provision of MakerDAO’s DAI stablecoin grew by 623% in Q3 2020, pushing the token’s worth above $1 for 4 consecutive months.

Since beginning July with a market cap of almost $130 million, DAI’s provide has expanded to greater than $940 million at this time.

DAI is created when Ether holders deposit their ETH into the MakerDAO protocol, permitting them to create the stablecoin utilizing Ether as collateral. DAI is an ERC-20 token and may then be used on the Ethereum community to generate curiosity or ‘yield’ utilizing DeFi protocols.

Messari attributes a lot of DAI’s latest progress to the launch of 4 important liquidity mining packages within the DeFi sector, together with a change to Compound’s (COMP) yield distribution that bolstered DAI rewards on June 30, the launch of Yearn Finance (YFI) farming on July 18, Curve’s (CRV) launch on Aug. 13, and the launch of yield farming for Uniswap’s UNI token on September 16.

Messari estimates that 65% of DAI’s total provide is at present being provided to DeFi protocols for yield farming.

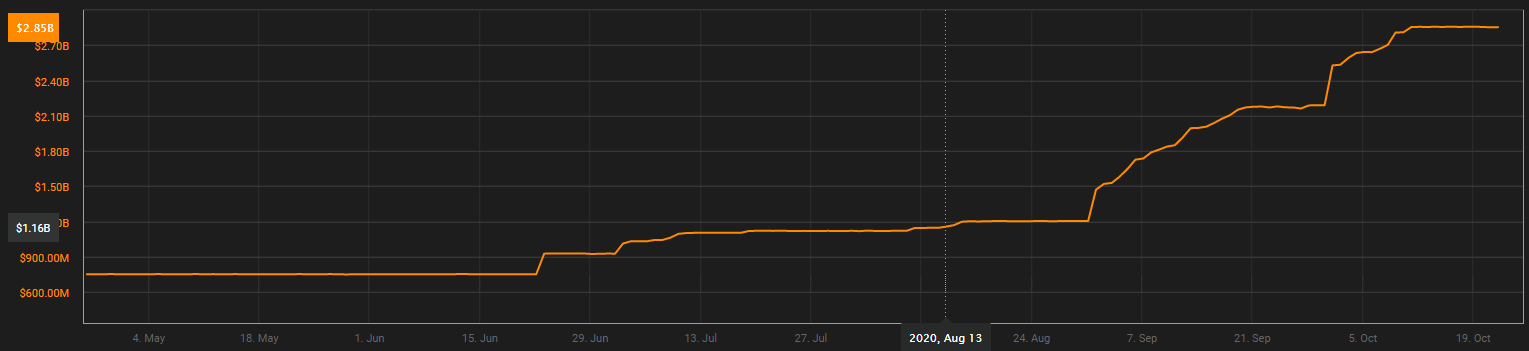

Demand for Circle’s USD Coin (USDC) equally exploded within the third quarter, with USDC’s market cap tripling from $928 million on July 1 to $2.79 billion at this time. USDC is the second stablecoin to develop by greater than $1 billion in a single quarter, after Tether (USDT).

Knowledge printed by Flipside Crypto indicated a surge in demand for USDC amongst DeFi customers following Curve’s launch — with USDC’s market cap rising by 150% for the reason that platform went dwell.

Messari estimates the capitalization of the mixed stablecoin sector grew by $8.2 billion in Q3 — greater than that of the earlier 4 quarters mixed. Of the sector’s $20 billion capitalization, the agency estimates 75% has been issued on Ethereum

USDC has additionally partnered with blockchain networks Solana (SOL), Stellar (XLM), Algorand (ALGO), and Circulation (FLOW).

[ad_2]

Source link